Thank you! Someone from our sales team will be in touch to schedule a demo shortly.

Risk free trial. Try at home for 30 days. Try now, buy later. Buy now, pay later.

We see these taglines used across ecommerce to convert shoppers. With a sea of providers offering these varied solutions, it’s hard for a Brand to know what to choose. Brands want clarity:

We’re here to help!

Let’s start by defining the space.

Buy Now Pay Later (or BNPL) providers enable brands to give shoppers the ability to split the cost of an online purchase over multiple equal installments. Usually shoppers have loan length options that range from 6-8 weeks to 3-4 years, depending on the provider and cost of the purchase. These BNPLs serve as loan alternatives to credit cards, which tend to have a much higher all-in cost for customers who “revolve” or do not make on-time payments. Brands can opt to offer interest free rates to their shoppers and take on the cost themselves, or choose to pass that interest rate onto their shoppers. Examples of these providers include Afterpay, Affirm, Quadpay, Klarna, and Sezzle.

Try Now Buy Later (or TNBL) platforms like TryNow, by contrast, enable brands to let shoppers experience their products before paying. The current online shopping model requires shoppers to commit to a purchase before they are confident in the quality of the product. TNBLs recreate the in-store shopping experience so shoppers can touch, feel, and try-on items in the comfort of their homes. Shoppers return what they don’t want and are only charged for what they keep. This model eliminates the uncertainty that is inevitable with online shopping by giving shoppers a more natural experience: to try first, buy later. Brands can choose the length of their trial and return periods, and choose to use the offering as an incentive in place of discounts to convert shoppers at higher rates.

What’s the shopper experience?

BNPL:

When a shopper checks out on a site that offers BNPL, they’re presented with the option to pay over time rather than the full cost upfront. Shoppers will need to fill out an online application, qualify for the loan, select their payment plan, and make payments through the provider’s app (or switch on autopay) until the balance is paid off.

TNBL:

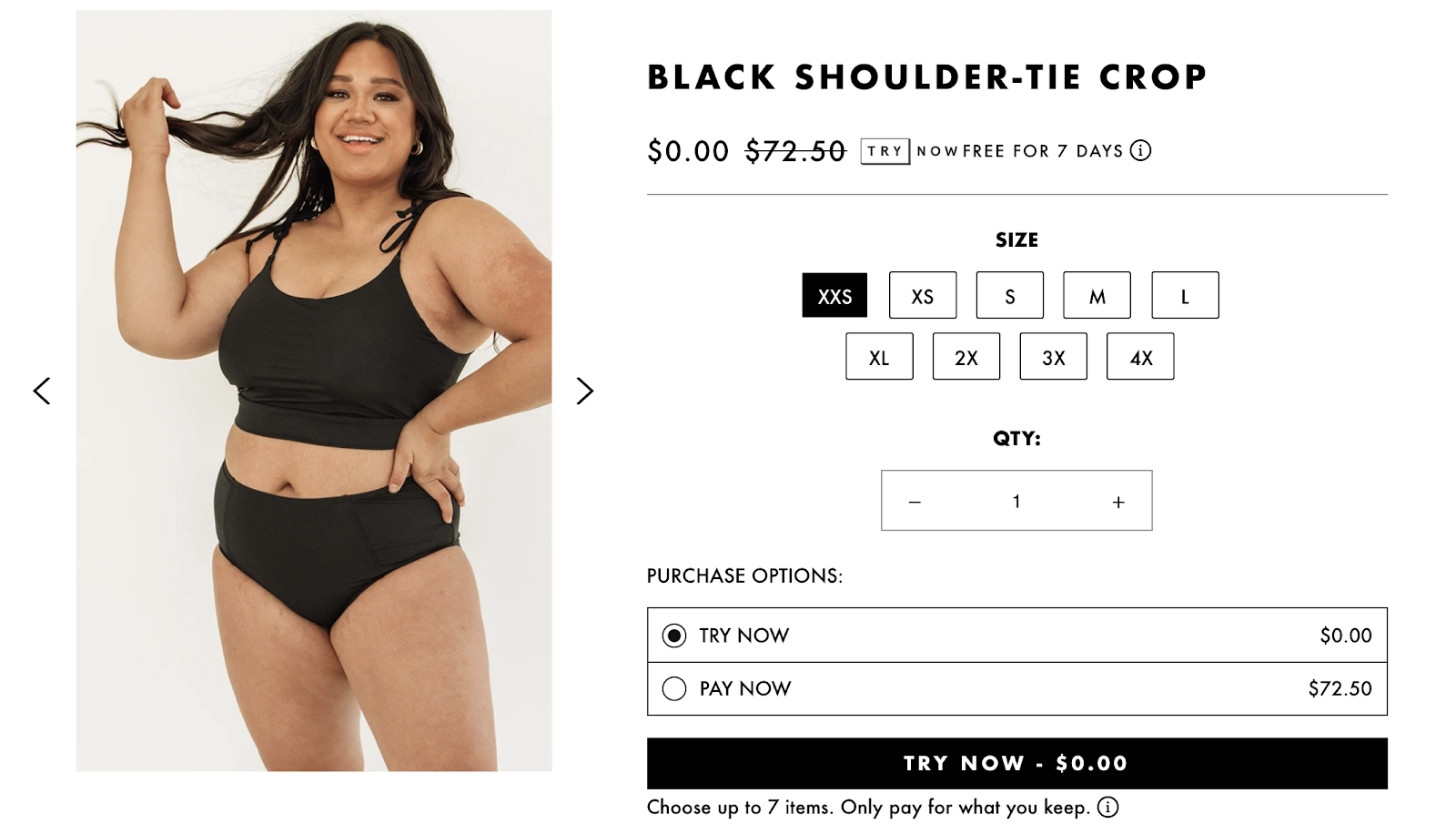

When shoppers are browsing a Brand’s site, they can choose to add items to the cart to pay full price (status quo), or they can choose to try first for $0. Shoppers can fill their carts like they would in-store with items they’d like to try, and checkout without being charged. No extra steps, no applications, no friction - shoppers simply enter their payment information so the Brand can charge later for items kept. When their items arrive, shoppers will have a trial period during which they can try their items, decide what they love, and send back what they don’t. Their card will be charged only for those kept items.

What problems do these programs solve?

On the surface, BNPL and TNBL sound like similar offerings, but they actually address different business challenges.

BNPLs help shoppers purchase something they know they want but might not be able to afford in one lump sum. BNPLs help brands expand the reach of their customer base by making their price points more accessible, and providing access to more affordable credit than the average credit card. BNPL works particularly well for high price point items like Peloton. In this way, BNPLs are tackling the problem of affordability and access to credit.

TNBLs, by comparison, help brands convert hesitant shoppers. Interested shoppers will abandon carts when asked to pay in the face of uncertainty. If they’re a first-timer to the brand or a return shopper looking to try a new item they haven’t touched or seen for themselves, they’re less willing to pay upfront. By offering TNBL, brands de-risk the purchase by letting the shopper check out with a $0 cart, and in doing so, increase shopper confidence, conversion, and revenue.

BNPL helps shoppers afford an item they know they want to buy, while TNBL gets the product into the shoppers’ hands, so they can decide if this is an item they will love.

How do I know what program will work for my business?

BNPL and TNBL can coexist on your site, or stand on their own. The question to ask yourself is, “What is the problem I’m trying to solve?”

If you have an amazing product but you struggle moving sticky metrics like conversion, TNBL is the answer. If you want to reduce affordability barriers for customers purchasing a high price-point product, BNPL is a good option.